These are words every marketer should tattoo on their foreheads:

“It’s not about us – it’s about them.”

Too often, those of us in marketing reach out to the market by touting our companies’ capabilities. In other words, we talk about ourselves – what we do, how we do it, why we’re better at it than our competitors. But just because we do it doesn’t make it effective. In fact, we all stand to benefit by recognizing that the best marketing isn’t about us; instead, it’s about our prospects’ needs and pain points.

By looking resolutely at everything from our prospects’ point-of-view, we put ourselves in a better position to accomplish our goals.

What does this mean?

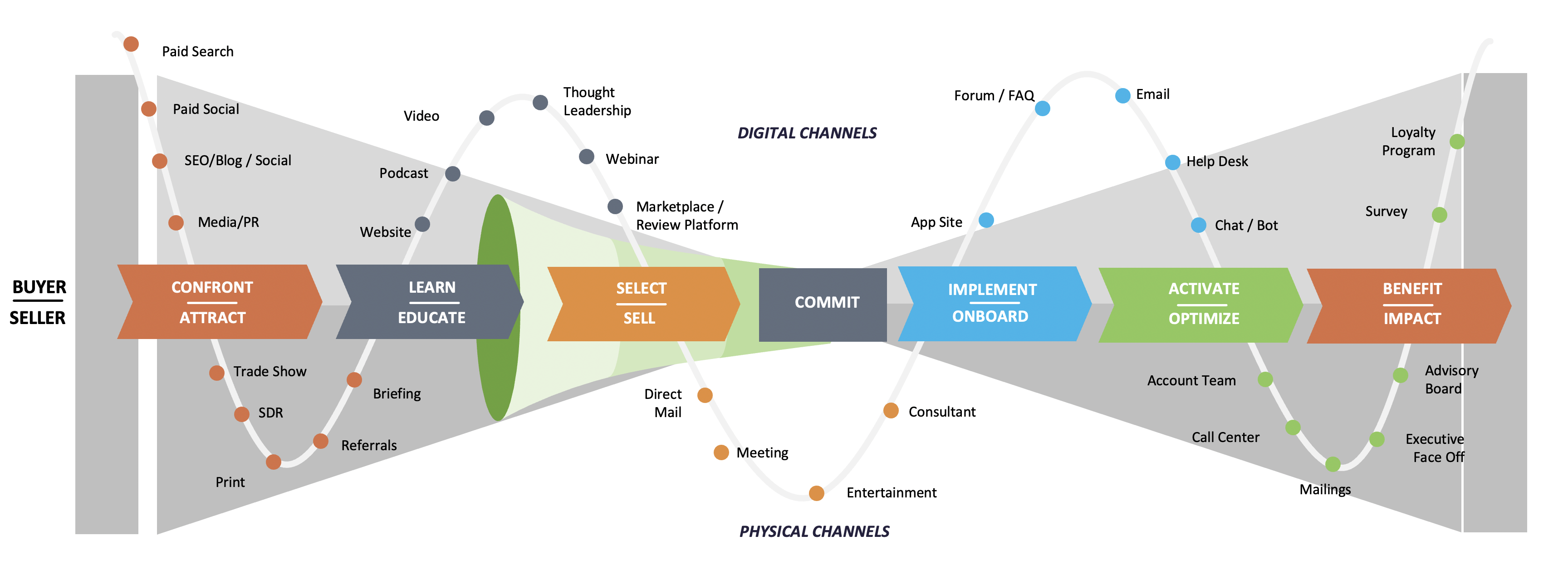

It means understanding where our prospects are in their buyer journey and communicating with them in a human way. We need to deliver content and messaging through coordinated campaigns that focus on their most urgent, visible problems. “Urgent” suggests that the need is important and immediate; “visible” assumes it’s close to the surface or can be raised through provocative messages.

The idea of urgent, visible problems is a key concept in effective advisor marketing.

Unfortunately, marketers too often neglect it in favor of self-centered messaging.

It’s easy to get caught up in inflated rhetoric that actually may be irrelevant to the typical advisor with specific, tactical problems to solve. This person simply doesn’t have the time or inclination to think in terms of grandiose concepts—not when they’re facing the pressure of addressing such challenges as their need to:

- Enhance their relationships with current clients

- Justify their fees and defend active management

- Reach out to a broader demographic of potential clients like women and Millennials

Not only do you need to show how you offer valuable insights that can help advisors address these challenges. You also need to demonstrate conclusively why it’s in their best interests to engage with your company in particular.

Inspire the next step.

Your content and messaging needs to focus on getting your prospect to engage – download, register, view a video or Webinar or otherwise raise his or her hand.

Relevancy is all-important here. Give your target audience information they judge to be less than pertinent to them, and they’ll quickly close their browser tabs. But give them a compelling reason to engage by making them an offer of content that promises useful insights on the business problems being solved, and you’ll be able to effectively move them to the next stage in their buy cycle.

Again, don’t lose sight of the singular objective of your efforts – generating inquiries and sustaining interest throughout the buying process. That’s how you’ll convert them to the point of sale-readiness. Continuously motivate them to take the next step, with as much content as is required to whet their appetites and keep them hungry for more.

Trying to persuade? Just answer the questions advisors are asking.

Understand what advisors are asking at each stage of their journey. And remember, prospective buyers’ questions are not linear. Rather, they can come in virtually any order.

- They may be wondering what they can do to bring the next generation of investors into the fold.

- They may be challenged by the need to be more digitally adept and looking for a solution set.

- They may have concerns about market volatility or heightened P/E ratios and wonder what steps they can take to minimize the consequences.

- They may simply want easy-to-digest literature they can share with their clients.

A good rule of thumb is simply to assume that the questions will probably be associated with the pains and challenges your prospects face.

What better opportunity for you to provide worthwhile solutions?

Download a copy of the Buyer Engagement eBook: “Exposed: The False Promises of Revenue Marketing”