Professional selling, at its core, is senior selling. It’s not about managing a junior team, but rather about seasoned experts doing the selling themselves – building personal brands, actively cultivating networks, and engaging prospects with unparalleled thought leadership and insights. Whether you’re a consultant adopting a seller-doer model or an expert selling high-value products and services, your presence and approach define your success.

In this landscape, LinkedIn stands out as an indispensable resource. It empowers senior professionals to connect directly with prospective clients, build undeniable credibility, and share valuable content that nurtures relationships and develops opportunities. Beyond one-to-one interactions, LinkedIn also offers powerful paid options to amplify awareness and drive lead conversions.

So, how can senior professionals truly harness the power of LinkedIn for sales? It boils down to a streamlined, three-step process: 1. Develop a Clear Strategy, 2. Establish Essential Systems, and 3. Execute Your Program with Precision.

Step 1: Develop a Clear Strategy.

As the old adage goes, “if you don’t know where you are going, any road will get you there.” Your LinkedIn sales efforts are no different. A brief but focused strategy session is paramount.

Know Your Audience, Precisely.

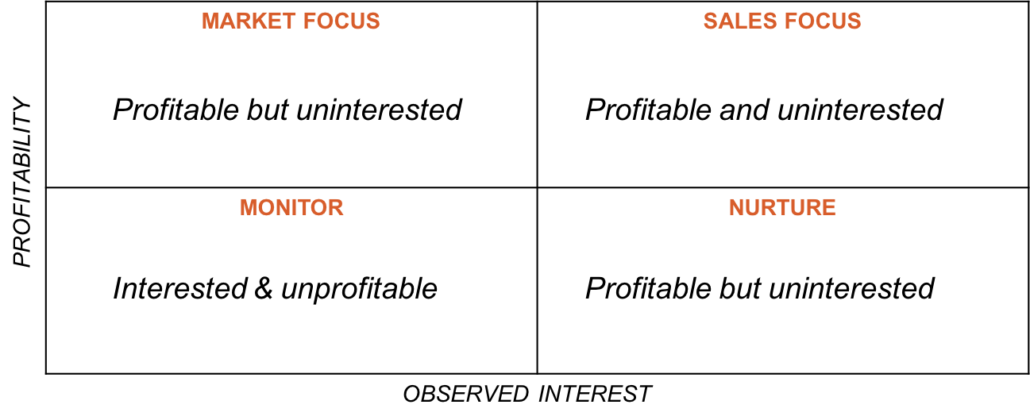

Who are you targeting? LinkedIn Sales Navigator is your secret weapon here, offering robust search and segmentation capabilities. You can pinpoint your ideal customer profiles (ICPs) based on criteria like region, industry, company size, and specific job titles. Are you aiming for particular companies or broader functional roles? Build these targeted lists directly within LinkedIn for seamless integration with your outreach.

Craft Your Message, Powerfully.

Once you know who you’re talking to, define what you’ll say and how effectively you’ll say it. This is where a professional writer or social selling expert can add significant value, helping you tailor your writing style to resonate with each audience. While you may not be creating the core thought leadership assets yet, you are crafting the persuasive messages that will appeal to target personas at different stages of their buying journey.

Remember, you’re likely operating at the top of the funnel on LinkedIn – building awareness and engagement through thought leadership or direct messaging. Your messages should be engagement-focused, emphasizing the value you offer rather than an immediate pitch. Be direct and to the point, respecting your buyer’s time.

In a competitive environment, gaining traction requires a compelling narrative. Design your messaging campaign using a “Pain-Empathy-Insights” approach:

- Pain: Articulate urgent, visible problems your audience is eager to solve.

- Empathy: Demonstrate a deep understanding of their challenges, laying the groundwork for a trusted advisor relationship.

- Insights: Offer objective thought leadership and content that provides genuine consideration toward solving their problems, independent of your specific solution. This earns you the right to deepen engagement.

These key messages will also serve as the foundation for your content assets, from core thought leadership (like a handbook or white paper) to derivative assets (blog posts, social snippets, emails).

Map Your Go-to-Market Strategy.

How will you engage this audience end-to-end? While LinkedIn is central, consider other channels that make sense for your buyers. Where do they “gather” online and offline? Beyond LinkedIn (which offers sponsored posts, InMail, and 1:1 engagement options), think about other social platforms, Slack communities, Zoom, email, and even phone calls.

Define Your Metrics for Success.

What does success look like for this program? Start with simple, bottom-up metrics. If your goal is to acquire, say, 5-10 new clients averaging $100K each within 6-12 months (totaling $500K+ revenue impact), you can reverse-engineer your campaign metrics:

- 5+ new clients ($100K avg) requires…

- 20 Qualified Opportunities (at a 20% conversion rate) which requires…

- 100 Leads which requires…

- 300 Engaged Top-of-Funnel Connections (or roughly 25 per month).

These numbers are a starting point for “funnel math” and can be adjusted as you gather real-world data. This exercise will guide your engagement strategy, including any budget allocation for paid media.

Embrace “White Hat” Methods.

Your professional reputation is paramount. While some automation tools and scrapers exist, we strongly advocate for a “white hat” approach. High-touch, personalized outreach and self-directed content strategies are superior to “black hat” tactics that risk LinkedIn suspensions or profile bans. If it feels creepy, it probably is.

Architect Your Engagement Program.

Outline the high-level sequence of your campaign. Will you outsource elements, or manage it entirely yourself? What’s the team mix of professional selling, marketing, and administrative support? Define which channels are most likely to succeed, what content supports your offer, your clear call-to-action, the conversion approach, and your follow-up process.

Define Your Channel and Media Mix:

- Messaging & Sharing: Direct Emails (1st-level connections), LinkedIn Direct Messages/InMail, participation in targeted Groups.

- Content: A core content asset (e.g., eBook, white paper), a series of blog posts, and their syndication on social media.

- LinkedIn Posts: Share professional expertise, experiences, and anecdotes (up to 1300 characters).

- LinkedIn Articles: In-depth pieces (up to 125,000 characters), ideal for thought leadership and sharing in LinkedIn groups.

- Social Media Amplification: Leverage Twitter, Facebook, etc.

- Paid Social: LinkedIn Advertising (Sponsored Content, Sponsored InMail), Twitter Ads.

- Search Engine Marketing/PPC: AdWords.

- Event Marketing: Guesting or hosting webinars, sponsoring conferences, speaking engagements.

- PR, Media & Communications: Influencer marketing, media placements, analyst relations.

Step 2: Establish Essential Systems

Once your strategy is clear, it’s time to set up the necessary foundations.

Cultivate a Powerful Personal Brand & Digital Hub.

Your personal brand is your most valuable asset. A strong LinkedIn profile and consistent online presence are crucial. Ensure your profile is up-to-date, speaks to your ideal target persona (rather than just being a resume), and tells your unique story. If prospects search for you, what will they find? Is it what you want them to see? If you’re directing them to a webpage, is it optimized with a clear call-to-action and trackable elements?

Implement Your Technology Stack.

LinkedIn (and Sales Navigator) will be central, serving as a source of accurate prospect data and offering powerful search parameters. Beyond LinkedIn, integrate your CRM, website, blog, landing page funnel, email marketing platform, and any customer data platforms. The goal is a seamless “tech stack” where all elements work in concert.

Define Clear Roles and Responsibilities.

Who does what, and when? Professional sales and buyer engagement require a personal commitment, but also effective marketing and administrative support. Technology facilitates efficiency, but the human element is key. Clearly delineate responsibilities to ensure smooth execution.

Step 3: Execute Your Program with Precision

With strategy and systems in place, it’s time to launch and iterate.

Marketing Execution: Build, Test, Run.

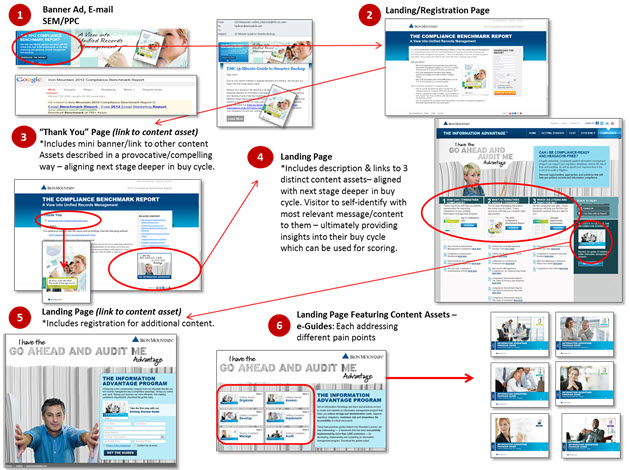

Sales, like all lead generation, is a numbers game. Start by creating your database of ideal targets using Sales Navigator and identifying relevant LinkedIn Groups. Build your core and derivative assets – your eBook, blog posts, social snippets, landing pages, thank you pages, and meeting schedulers. Use compelling graphics, media, and clear calls-to-action to engage and drive conversions.

A simple outbound engagement sequence might look like this:

- Outbound Message #1: A personalized, short introduction.

- Second Message: Incorporating the “Pain, Empathy, Insights” framework, linking to high-value educational content.

- Third Message (Optional): An invitation to an event or a direct suggestion for a 1:1 meeting via a scheduling link.

- Confirmation Message: As appropriate.

- Follow-on Invite: To an event or webinar.

- Nurture: If not ready, add to a nurture list.

This sequence can be powerfully combined with paid social and retargeting to build brand recognition and impressions within your target accounts.

Adopt a Metrics-Driven Methodology.

Remember your “funnel math.” For every 100 relevant requests, connections, or conversions, track your yield. For high-value B2B programs, even a modest conversion rate can generate significant opportunities. Measure followers, impressions (for awareness), visits from target company IP addresses (for account-based programs), and the level of engagement (messages exchanged). For lead generation, track conversions from LinkedIn-initiated interactions (e.g., landing page visits, meeting bookings) all the way into your CRM. Continuously measure, learn, and adjust your strategies for optimal performance.

Good luck, and good selling!

We published an e-book series that describes the 9 Principles of Effective Buyer Engagement. These principles serve as a practitioner’s guide to increasing leads, conversions, pipeline velocity, and revenue impact.

We published an e-book series that describes the 9 Principles of Effective Buyer Engagement. These principles serve as a practitioner’s guide to increasing leads, conversions, pipeline velocity, and revenue impact.