An Integrated Digital Strategy clarifies how you differentiate your online presence and drive revenue with your website, mobile, social media, search, email marketing, apps and online advertising. Using analytics to capture customer insights will inform your digital strategies and tactics and keep you aligned around key performance indicators (KPIs).

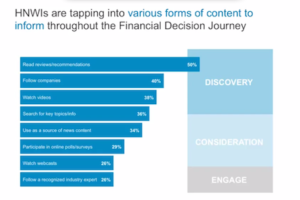

As more customers ‘self-sell’ on the web, a digital strategy is increasingly important. It is about integrating digital into all facets of marketing and describing the role of different web channels, inbound marketing, content marketing, search and the role of and social media. Integration can range from adding a URL at the bottom of a print ad to having a common creative message on your home page and in banner ads to the sophisticated delivery of sequenced messaging on multiple digital media vehicles.

Source: RevenuePerform.com

Disruptive Technology Driving Digital

Four specific technology developments are driving a tectonic shift in the digital ecosystem:

- Mobile. Widespread penetration and evolution of feature-rich, smart mobile devices

- Social. Ubiquitous social networking and user-generated content

- Cloud. On-demand, real-time access to supercomputer power and unlimited storage

- Internet of Things. Convergence between the real and the virtual worlds.

These technologies are changing the relationships between consumers and companies. Consumers have more power to gather and process information, connect, and voice opinions. And companies can leverage vast new sources of consumer information that lets them engage customers in a microtargeted way across multiple digital touch points.

What’s the State of your Integrated Digital Strategy?

To win in the digital economy, explore new approaches and learn by experimentation, while focusing on crucial capabilities and overcoming any gaps. Ask these questions:

- Do we have a dynamic digital strategy that generates value and considers new business models?

- Do we have deep insight into how our customers are using new digital tools?

- Do we have a partnership strategy with the key technology players to enable us to respond?

- Does our marketing strategy take advantage of new technologies to enhance our traditional campaigns?

- Are we fully utilizing online and mobile channels as part of our go-to-market strategy?

- Do we have the right talent and organization to execute our digital strategy?

Addressing these questions and formulating an integrated digital strategy will ultimately make your businesses relevant in a digital era while growing opportunities and profits, as well as scaling efficiently in the process.

Identify opportunities to address now with DIGITAL EXPERIENCE INDEX.

Revenue Architects is here to help with our digital marketing assessment using the DXI or DIGITAL EXPERIENCE INDEX. It’s complimentary!

The Digital Experience Index (DXI) is based on eight interdependent dimensions: Brand, Visibility, Design, Content, Usability, Functionality, Conversion and Amplification.

Despite this, only 6% of small business websites are mobile ready according to a

Despite this, only 6% of small business websites are mobile ready according to a