Recent studies indicate that financial advisors expect continued strong demand for their services in the next year. Russell Investments third-quarter Financial Professional Outlook indicated that Advisors remain bullish about the capital markets looking out over the next three years.

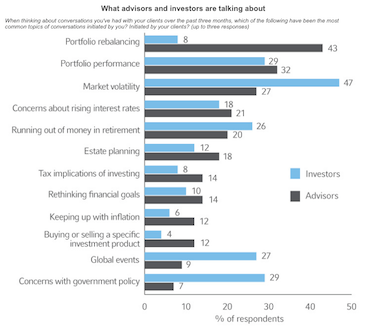

However, they worry about investors’ emotional response to market events that could harm their businesses and their clients’ well-being, The Russell Investments study showed market volatility to be the most common topic initiated by clients. A Fidelity Advisor Investment Pulse Survey showed similar results.

“When investors make emotional decisions, they decrease the odds of reaching their financial goals,” said John Hailer, chief executive officer of Natixis Global Asset Management in the Americas and Asia.

How can financial advisors set reasonable expectations with challenges like volatility and low-interest rates?…how can they take the emotion out of investor conversations to set realistic goals and stick to them?

Gauging a client’s risk tolerance can be challenging. A major player is FinaMetrica (since 1998), an acclaimed psychometric based risk profiling tool and a quantitative methodology of linking risk tolerance scores to asset allocations and analysis. Its available internationally and in several languages.

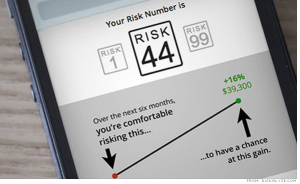

A newer venture-backed player that’s getting attention among advisors is Riskalyze founded in 2011 that has a process that it says takes “subjectivity and guesswork out of risk analysis.” Investment advisors are empowered to capture a quantitative measurement of client risk tolerance to find investments that fit them.

In contrast to other more common qualitative and psychological questionnaires that some firms rely on that can be subjectively weighted, Riskalyze applies Modern Portfolio (Prospect) Theory. It doesn’t disclose the methodology, however, the “secret sauce” behind it.

Riskalyze Review

How it works:

1) Investor Risk Tolerance Questionnaire

- An investor answers some dozen questions to quantify exactly how much risk s/he is willing to take.

- At the end of the assessment, Riskalyze assigns a so-called risk fingerprint, which is a number between 1 and 99. A score of 1 is a sign that the investor wants to avoid almost any risk while a 99 indicates a strong willingness to accept volatility if it meant that there was also a chance of huge gains. Riskalyze’ experience has shown 4 out of 5 have more risk than they realize or want. For example, an investor may score as a 31, but their self-managed portfolio is actually a 75.

*The risk number is based on past performance and correlation.

Further the probability is 95% for 6 months.

2) Portfolio Analysis/Modeling and Alignment.

- With investor’s Risk number in hand, the advisor uploads investor’s current portfolio into Portfolio tool to calibrate individual sensitivity for near-term drawdown risk and volatility.

- In a 1:1 with client, advisor conducts what if’s, account comparisons to align portfolio to client expectations – so that they can stick to it.

- In August Riskalyze, launched faster, smarter and more flexible Portfolios tool for advisors to engineer and optimize the risk in a diverse array of portfolio choices. There is a light stress-testing tool as well.

Marketplace Response:

The Riskalyze platform has gotten high marks as a marketing tool –

- The questionnaire tool can be embedded in an advisor’s site and be part of an integrated email campaign.

- The questionnaire is responsive (i.e., optimized for mobile as well as PC/laptop); provides a good user experience and takes only 10 minutes to complete.

- Advisors automatically receive questionnaire results for prompt follow-up.

We believe that you can use risk to win new business in a very effective way, says Riskalyze CEO Aaron Klein.

Notwithstanding, like any lead generation effort, it’s only as good at generating leads as the marketing program surrounding it. Effective messaging is essential from an email campaign and a Call-to-Action on a website to the landing page and more. While Riskalyze has just released a marketing toolkit for advisors ( collateral, PR, etc.), they do not offer marketing consulting services for financial advisors to design and implement marketing campaigns.

Riskalyze has gotten some criticism too around the defensibility of projecting “future returns from past performance on any individual investment.” See Risk Tool Smackdown: FinaMetrica vs. Riskalyze

Holistically, the Riskalyze platform/process is a effective way of demonstrating to investors just how tightly aligned their investments are with their risk tolerance, and mitigating emotional risk with goals-based investing.

Riskalyze is gaining traction among financial advisors and continues to innovate/advance its platform. However, this is a new space in the US and there are other players. Trial before you commit.

If you’d like to learn more about how we help evaluate your risk strategy and tools and marketing/positioning your firm for growth, please contact us.

Leave a Reply

Want to join the discussion?Feel free to contribute!