Many independent financial advisory firms are at an inflection point, facing disruptive changes from technology and generational transitions.

Technology-Driven Transitions

- Emerging “Robo-Advisors” who are seemingly adept at gathering assets from Internet-savvy millennials

- Digital Nation: Increasing use of social media and mobile devices among all generations, and most effusively by millennials

- Real-time access to almost anything

Generational Transitions

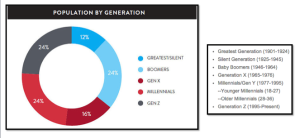

- Generation X or “Generation Now”: Following on the heels of existing pre-retiree and retired clients is Gen X ages 30-45, who currently control nearly $3.5T in investable assets (Cerulli – Lodestar, 2012E.)

- Generation Y: 77 million strong, on par with Baby Boomers, constitutes 24% of the US population (Nielsen)…clients of the future…the social generation defined by technology – always on and mobile.

- 71% of affluent Gen Y investors report having $100K-<$250K in total investable assets and an additional 5% are already millionaires. (Cogent Research 2013)

These disrupting transitions are a “wake-up” call for traditional advisors to evolve their firms to survive and thrive in the future.

Should advisors be afraid? How can advisors position their firms to compete and grow in a disruptive environment?

Many advisors have successful growing firms, but are slow to adopt technology and find themselves at a crossroads. And advisors nearing retirement need to be thinking about succession planning and capturing the next generation of wealthy clients.

The key is to meet their clients where they are — be they pre-retirees or young and mid-career accumulators. This may require a refresh of proven strategies while also adopting new approaches. This more agile and integrated approach is what we call a Revenue Architecture and it blends critical strategy, systems and programs capabilities needed to drive top-line growth.

Here are three things to do:

1) Articulate a Differentiated Positioning

Define Your Target Clientele

Robo-advisors have shown they’re adept at gathering assets from Internet-savvy millennials at low-cost and will open up client conversations around pricing transparency and what value advisors bring. Clearly defining your clientele (e.g., mass-affluent and high and ultra net worth) and segments (e.g., medical, high-tech professionals and business owners/entrepreneurs) along with your value proposition will strengthen and differentiate your competitive positioning.

Update the Value Proposition

Deliver a well-thought through explanation about the value your firm offers to these targeted segments. This may include more complex, and customized high-touch specialties that focus on all aspects of a client’s financial world. Examples may include trust and estate management, individual and family/multi-generational wealth management, personalized financial planning, tax-efficient asset management and more. Financial planning — your client-centered approach-process and your specialties for a defined client segments — are your “anti-commoditization.” Changing financial behavior requires more than just an efficient technology — this personal interaction is perhaps your biggest differentiator.

2) Embrace the increased use of technology to:

Augment Client Relationships

The right mix of digital services combined with personal touch expert advice can truly empower you. It will augment the client relationships and enhance communication and collaboration. For example,

- Provide clients with a personal portal, e.g., with a performance reporting dashboard they can access whenever they want. Platforms such as ModestSpark provide robust, visualized reporting along with document sharing, web/social media linkage and more.

- Use virtual meeting tools such as Skype, GoToMeeting

Automate, Systematize

Many of the tools Robo-Advisors implement are not unique — they are systematizing and automating passive strategic portfolio construction using such things as automated rebalancing which can be implemented effectively by human advisors as well. Your business needs to be nimble. Operational efficiencies, systematic workflows will allow more time to focus on the human touch.

Modernize Marketing

Modern marketing is always on, multichannel, and content-driven; it’s fully optimized for the digital, mobile, and social activities of today’s tech-savvy populations. At the core is your marketing hub, that is a responsive (i.e., mobile optimized) website. There are modern marketing tools that will yield efficiencies from marketing automation (MA) suites (e.g. SharpSpring, HubSpot), to customer relationship management (CRM) solutions and content management systems such as WordPress and analytics — all of which can be right sized and right-priced for your firm.

Learn More

- For example, SharpSpring marketing automation suite is a great fit, value-priced, for many financial advisory firms, offering powerful features to increase and optimize your marketing activity.

3) Include Younger Advisors in Succession Planning and Consider 2nd Tier of Services

Succession planning must also include younger advisors who look like and connect with the next client generation. Consider two tiers of service, each combining the appropriate mix of high-tech, high-touch according to the profile of each client: Tier One being more traditional services and pricing for pre-retirees and retirees and Tier Two (new) being simpler and low-cost for Gen X-Y clients, especially children of your clients.

You might even consider partnering with a robo-advisor for a white labeled service for Gen Y millennials and younger GenXs. Whatever approach is taken, the aim is to have a low-cost service pathway to Tier One. Some worthy goals for a Tier Two service include:

- Establish and nurture relationships through multiple outlets (social, mobile, interactive)

- Adopt tools that simplify millennials’ life and financial planning needs

- Practice authenticity and transparency

- Provide content that helps them make more informed decisions

- Engage in a way that reflects their values and aligns with their priorities

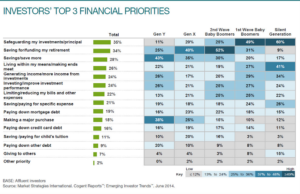

In short, getting into the mindset and understanding the everyday motivations of GenY and GenX investors is critical to fine-tuning a relatively low-cost solution and service pathway to Tier One. See graphic below for emerging investor priorities vs. older generations.

The good news is there that there is an opportunity for traditional firms to defend — actually improve — their competitive position and growth by refreshing proven strategies while also adopting new approaches around a differentiated value proposition, integrating digital tools/services with trusted advisor personal touch and nurturing emerging investor generations: Future HNWs.

Revenue Architects is working with both leading asset management firms and advisors in shaping next generation strategies for growth. Ready to get started, want to learn more and engage some help, contact us.

Leave a Reply

Want to join the discussion?Feel free to contribute!