Financial Advisors are an amazingly difficult prospect to engage. They are incredibly busy and already have a wealth of resources already available to them – do they even need to engage with wholesalers? The best way to convert financial advisors to customers is to build your marketing automation program around them.

Lead generation starts with effective segmentation

Before focusing on key strategies, Sales and Marketing must have defined a set of engagement personas and customer segments. Marketing has had personas for a decade but only since the advent of marketing automation software have engagement personas become empowered and brought to life.

Defining financial advisor segments for lead generation

Creating clarity with Sales is a two step process:

- Lead scoring – a measure of how active a financial advisor on your digital properties

- Lead grading – a measure of how profitable the financial advisor is likely to be

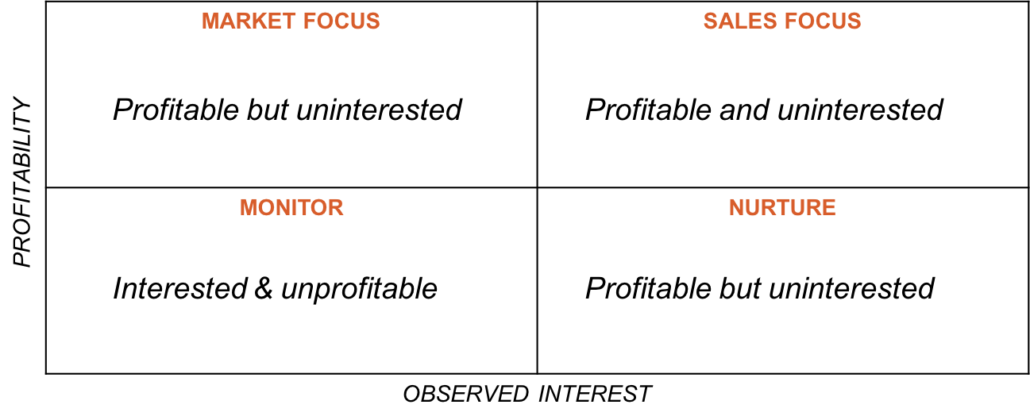

It may take several iterations to get lead scoring and grading optimized, however, the process should be fruitful for Sales and Marketing. The process crystallizes Marketing and Sales perspectives around which advisors are most profitable and which digital behaviors are believed to be most relevant to a sale. Some marketing automation vendors have one score that represents profitability and interest. However, being able to separate advisor behaviors from profitability factors simplifies discussions by clarifying customer segments by profitability as seen in the above graphic. As an example, Pardot applies a numerical value for an advisor’s lead score and a letter grade (A-F) for an advisor’s expected profitability.

Dynamic Content makes Asset Manager content relevant

Building your program in an advisor-centric model ensures advisors receive relevant emails and experience relevant content on your website. More targeted communications with customized messaging leads to a higher conversion rate. Different vendors implement dynamic content differently but dynamic content can be inserted into email, landing pages or web pages. Dynamic content allows digital marketers to tailor the content based on any attribute of the customer contained in their Marketing Automation profile.

Dynamic Content Examples

Here’s a web example. Let’s say you have an investment product A on the recommended list at wirehouse B. You can feature that product on your web pages for visitors from that firm. You might not want to create dynamic content for every firm, but it certainly is a good idea to create dynamic content for recommended products at key distribution firms.

Now for an email example. Let’s assume you send a regular email to advisors that use your investment products in client portfolios to keep them informed of how the fund managers are viewing fund performance. You can create dynamic content for your key investment teams – short summaries of manager commentary with links to more. Your marketing automation program will be able to send a customized digest email with highly relevant content featuring information for all the investment products an advisor is using. This is an email an advisor will welcome and even look forward to.

Behavior-based communication puts the advisor at the center

A behavior-based communication strategy builds on your previous work on building engagement personas and your segmentation strategy. The driving principle is to observe your prospects behavior and let that be your guide to better attract that individual prospect. Some examples will clarify the concept.

- An advisor has shown a preference for a type of content – videos, whitepapers, etc. Use dynamic content configurations, provide that advisor the type of content they prefer

- An advisor is visiting product web pages for products not currently being used. Sounds like a revenue generation opportunity for a cross-sell. Automatically add the advisor to a nurturing campaign for that product

- An advisor is active on your website site but not opening emails. If this prospect is likely to be highly profitable, send them an engaging direct mail piece with a call to action that drives them back to the site. If they follow up you’ll know that advisor prefers good old fashioned snail mail

One last word on behavior-based communication. While marketing automation programs prefer to function in linear, scheduled campaigns, today’s consumer has grown accustomed to binging. Be it on Netflix programs or investment information. Configure your marketing automation program to suit your customer’s content binging habits. There is no need to wait a week for a follow-up email; start providing relevant content right away. Some of this can be automated, some will require exporting details to a spreadsheet for analysis before reprogramming your marketing automation system.

Leave a Reply

Want to join the discussion?Feel free to contribute!