Recent studies indicate that financial advisors expect continued strong demand for their services in the next year. Russell Investments third-quarter Financial Professional Outlook indicated that Advisors remain bullish about the capital markets looking out over the next three years.

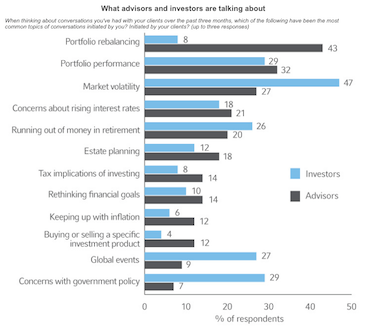

However, they worry about investors’ emotional response to market events that could harm their businesses and their clients’ well-being, The Russell Investments study showed market volatility to be the most common topic initiated by clients. A Fidelity Advisor Investment Pulse Survey showed similar results.

“When investors make emotional decisions, they decrease the odds of reaching their financial goals,” said John Hailer, chief executive officer of Natixis Global Asset Management in the Americas and Asia.

How can financial advisors set reasonable expectations with challenges like volatility and low-interest rates?…how can they take the emotion out of investor conversations to set realistic goals and stick to them?