Instead of using a traditional opportunity funnel (sales pipeline) to drive toward a revenue goal, extend your funnel view past revenue to company profitability. Why? To create a revenue acceleration engine that uses the interconnected metrics of both pipeline and profitability to sustainably fund growth initiatives. Keep reading to learn how.

The Opportunity Funnel is Great for Managing to a Revenue Goal

The traditional opportunity funnel (sales pipeline) used ubiquitously by sales and revenue leaders, is indispensable for managing metrics to reach quarterly bookings targets and revenue goals.

Close deals, add new funnel at the appropriate pace, and bookings targets will be met. When you hit the inevitable funnel snags, adjust marketing or sales activities to add more funnel, qualify out sooner, or close deals faster. It’s just math. And as a tool for managing to a revenue goal, this traditional opportunity funnel works incredibly well.

Combine Pipeline and Profitability Metrics to Drive Revenue Growth

What you can’t do with an opportunity funnel (sales pipeline) is manage to a profitability goal. Cost isn’t a component of this or any funnel. Opportunity funnel metrics stop when a deal is booked. Also, why would you want to?

Here’s why. Companies looking to accelerate revenue growth need enough contribution margin to fund necessary growth initiatives. This could mean hiring sellers with a different skill set, training them on AI, segmenting clients so you can serve them differently, improving customer satisfaction scores, expanding sales territories, cutting SGA expenses, etc. Pipeline and profitability metrics can be combined into a single “Extended Funnel” view that helps you manage not just to a revenue goal, but a revenue growth goal.

Set Aside a Portion of Contribution Margin to Fund Revenue Growth

Growth initiatives cost money. Unless you have an external funding source, you must set aside a portion of contribution margin to enable revenue acceleration. No contribution margin, no revenue acceleration.

Our position is that the traditional opportunity funnel can be extended past revenue to include gross margin, acquisition cost, and contribution margin. And this “extended view” of the funnel makes it easier to manage interconnected pipeline and profitability metrics to self-fund revenue acceleration.

An “Extended-Funnel” View Reveals Revenue Acceleration Potential

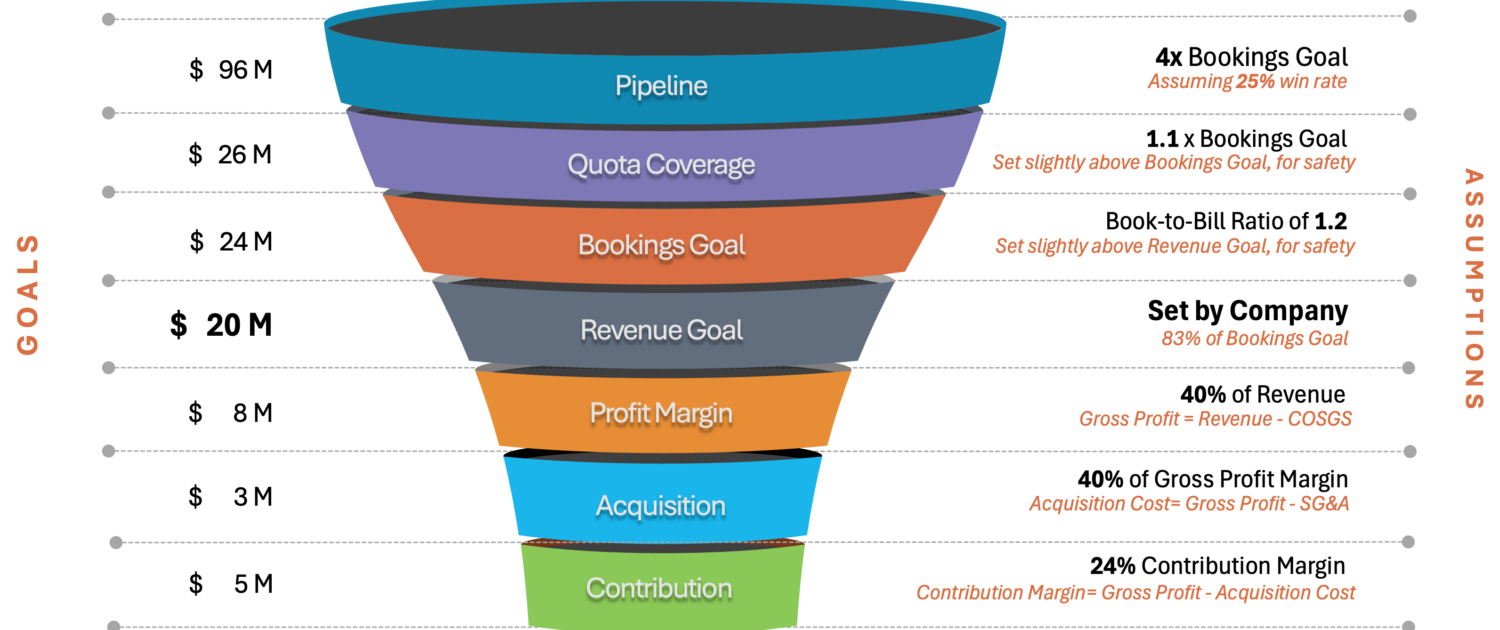

Here’s an example of what this “extended funnel” view looks like.

To the left is a set of ideal extended funnel targets. To the right is a set of assumptions used to calculate these targets. The model ensures the company can continually deliver enough contribution margin to fund growth initiatives. This makes revenue acceleration not just doable but sustainable. We call this “comprehensive funnel math.”

A current-state assessment of the extended funnel, for comparison, is also built. To sustainably accelerate revenue growth, the company must close the gap between current and ideal states. Remember, the goal is to generate enough contribution margin to self-fund growth initiatives.

Reaching Ideal Comprehensive Funnel Math

Taking action to improve your comprehensive funnel math is neither trivial nor easy. But consider how the extended funnel view can better focus your business priorities!

This is exactly what a late-stage biotech client did to accelerate revenue growth. After a “comprehensive funnel math” analysis using diagnostic tools, we discovered they didn’t have the right sales organization or selling skills to be successful. Once this situation was remediated, the company began generating more sales and margin to self-fund additional growth initiatives.

Does This Describe You?

If you’re excited about this, you’re a CEO, CRO, or Private Equity Portfolio Manager in one of the following situations:

- You will miss your Q1 target; accelerating revenue is now the only way to hit the annual target

- You have successive quarters of declining revenue

- You have under-performing companies in your portfolio and need to ensure they exit on time

- Your investors will not offer additional funding to improve performance

- You’re hitting your targets but feel you can drive even more growth

Use Comprehensive Funnel Math to Create a Revenue Acceleration Flywheel

Optimize an “extended funnel” for profitability goals, not just revenue goals. Reinvest newly available contribution margin into revenue growth initiatives. The result will be a self-funded revenue-acceleration flywheel.

Hope Eyre is a client partner and management consultant at Revenue Architects. She specializes in sales effectiveness, funnel metrics, and revenue growth.