That’s the goal of NAPFA (National Association of Personal Financial Advisors) with the recent launch of the FeeOnlyNetwork.com for its more than 1,500 Fee-Only member advisors across the country. A parallel goal is to build the NAPFA brand and promote the benefits of working with NAPFA-registered investment advisors (RIAs) for comprehensive financial planning and fee-only compensation.

This comes as Fee-Only Registered Investment Advisors (RIA) have surged and changed the way Americans invest. This in a climate where investors are more risk adverse, want to be involved in the investment process and, for all generations, increasingly use the web to “self-sell” before engaging. Having a strong web presence — including a dynamic web marketing hub, social media significance, thought leadership content and digital marketing programs — is not an option, but an imperative for advisors to be relevant and competitive today.

With FeeOnlyNetwork.com, Individual NAPFA members receive a free, search optimized profile and those who wish to pony up $250, receive a more sophisticated profile with more content, enhanced optimization and linking features. The value proposition seems solid: members can piggyback on the broader branding effort around “Fee Only” with NAPFA and generate leads and SEO value at a reasonable cost per year.

There are a number of things for members to consider in maximizing the value and effectiveness of their profiles. (See FeeOnlyNetwork mockup)

-

- Differentiate the message beyond “Fee-Only”

Use the bulleted specialties adjacent to photo and paragraph beneath it, to provide more depth and breadth surrounding resources and investment options offered, akin to what you might get from a broker dealer.

- Choose messaging carefully

Avoid “generic” messages like “specializes in financial planning and investment management”; be more sophisticated.

- Align Profiles & Links

Make sure your profiles line up across all your channels – LinkedIn, Website, Facebook, Twitter, FeeOnlyNetwork, etc. – including key words, messaging and positioning.

- Include Links

Make sure all your publicly available links are reflected on the profile and picked up by FeeOnlyNetwork.

- Complete all of the Profile Features

This includes links to all of your social media profiles, recent articles, media mentions, welcome video and the like. If you have more than one location, be sure to include it as well. Also complete the company profile tab. There will be an ability to cross-link with other NAPFA members in your company.

- Show Bench Strength:

The network is very “planner” and individual based rather than the firm… some investors may want to see that they can engage a firm with a broader set of expertise and specializations within the firm. This can be done with the company profile tab, but perhaps you can influence the site’s positioning if you want to highlight both you and your company more strongly.

- Generate Leads:

Currently, the “Contact Me” button generates an email, however there are plans to enable a form. Be on the look out and perhaps influence its development. For example if it were a “Learn More” link instead of “Contact Me”, that could lead to a landing page on your website where they can further “opt-in” to learning without feeling the need to email you right away. Many “buyers” want to self-sell and learn about you (and others) without converting immediately to an email or meeting.

NAPFA says it has made a significant investment and allocated considerable resources to the FeeOnlyNetwork.com, a partnership with Advisorology, LLC, the parent company of the FeeOnlyNetwork.com and FinancialAdviceNetwork.com. The partnership promises to continue to enhance the FeeOnlyNetwork.com. Members would do well to actively participate in its evolution.

Thérèse Byrne is a Client Partner & Digital Strategist with Revenue Architects specializing in helping clients take advantage of modern marketing approaches to projects from the vantage of creative, innovative and agile solutions to growth. She works with a number offinancial advisor clients developing strategies and implementing compliant marketing solutions enabled by technology and inbound marketing.

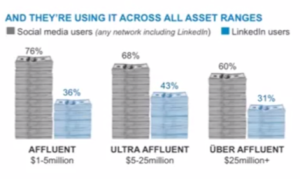

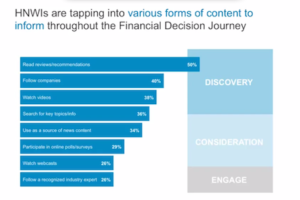

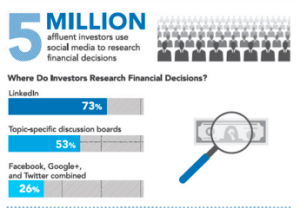

Since the private equity business is dependent on relationships with a finite number of LPs, executives and entrepreneurs, you need to be sure you can identify every potential opportunity to engage with your target audience. With 3 out of 4 Americans using social media, various platforms like

Since the private equity business is dependent on relationships with a finite number of LPs, executives and entrepreneurs, you need to be sure you can identify every potential opportunity to engage with your target audience. With 3 out of 4 Americans using social media, various platforms like