Content is the thread that connects marketing and selling.

Done correctly, content gives you the ability to:

- Engage with your prospects

- Advance their understanding that what you have to offer can make a difference to them

- Eventually, convert them into buyers

Only by fully understanding your prospective buyers’ pain points, key challenges, intents, preferences, and more can you create content that truly resonates with them.

Let’s review some simple pointers that can help you create content of this kind.

START BY PUTTING YOURSELF IN YOUR PROSPECTS’ SHOES

Ask yourself if the content you’re creating and the experience it engenders is relevant, valuable, unique, compelling, provocative, exclusive, and/or enticing. In short, do something different.

To evaluate the quality of your content, ask yourself these telling questions:

- Will our content help prospects address key problems and challenges they’re facing?

- Will it provide them a framework to better evaluate their challenges and begin assessing approaches to solving them?

- Will they interrupt what they’re doing to acquire and interact with our content at the point of our presenting it to them?

Unless your answers are yes, yes and yes, you’ve got more work to do.

THIS SHOULDN’T BE THE PROVINCE OF PRODUCT OR CORPORATE MARKETING.

60% to 80% of companies today, including those that pay homage to the importance of content, fail to experience success because they consign content strategy and development to Product or Corporate Marketing. In turn, those marketers allow product and brand messaging to define content’s composition. They develop creative messages that are often product- or brand-centric, and then they promote the content in calls-to-action across a host of digital and social media channels.

They’re creating monologues, not dialogs.

Our recommendation – invert the approach. Determine who to target and what’s important to them (their pain points, for example) and then develop your content before the campaigns and creative process begins. Then, and only then, develop creative that’s intended singularly to promote the content asset(s).

And always make sure that it’s your Demand Generation people who are leading the charge.

CONTENT ATOMIZATION – MAKING MORE OF WHAT YOU ALREADY HAVE.

Content “atomization” allows you to extend your content into component parts, thereby reinforcing your narrative and messages by serving up “bite-sized chunks” of information.

Using this technique, a single “pillar” content asset such as a white paper and be re-used in hundreds of different ways – as blog posts, infographics, webinars and more.

It’s the smart way to feed the machine.

BE GUIDED BY THE PRINCIPLE OF EQUITABLE EXCHANGE.

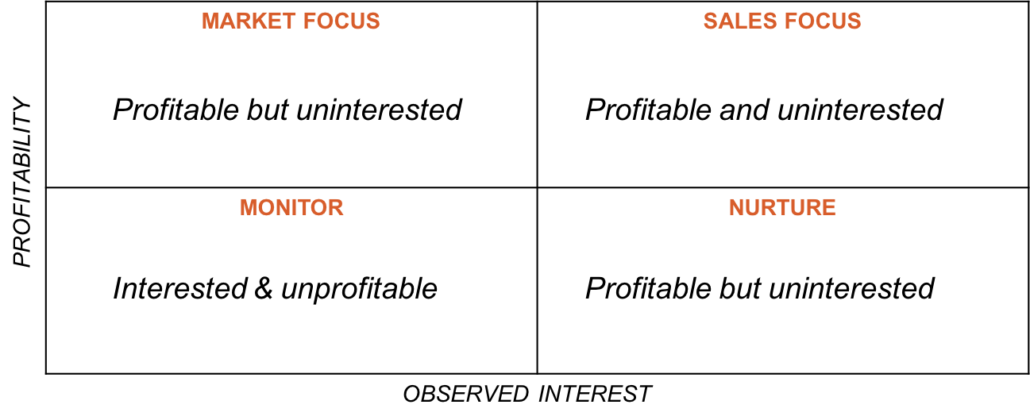

Effective content marketing is a function of nurturing a prospect from interest to commitment. In that context, it’s worth spending a minute on a concept known as Equitable Exchange – what are you going to give to your prospects and what are they willing to give you in return?

At the beginning of the buying cycle, you’re looking for permission to continue the dialogue. The prospects award you this in exchange for a non-obligatory content asset of perceived value. It may be a white paper or a sales aid – something that helps prospects gain insights, build knowledge and ultimately do their jobs more effectively.

Going forward, you’re looking for qualification and readiness, while your prospects are looking for solutions and credibility. The equitable exchange shifts to an often more obligatory value equation. Content can be case studies, tools and other assets of higher perceived value that can move the process along.

Just remember, content isn’t a tactic – it’s a strategy. It’s the strategic element that inspires your target audience to carry on a dialogue with you.

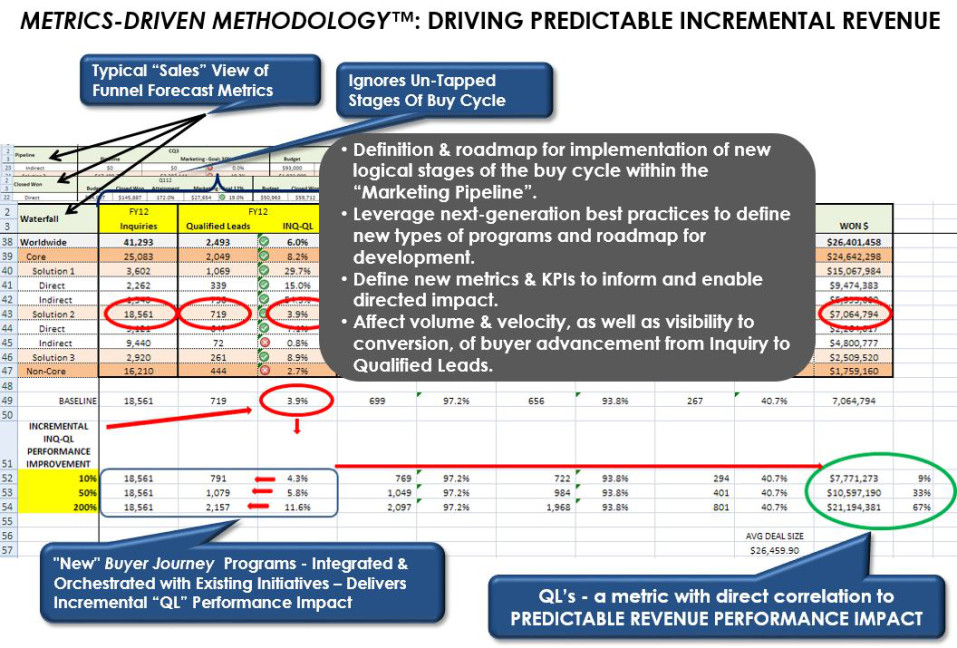

See illustrative metrics, listed hierarchically from most important to least important

See illustrative metrics, listed hierarchically from most important to least important