Have you Calibrated Metrics-Driven Advisor Engagement?

To engage advisors, you are using various communications tools/media channels roughly based on their ability to help you target your audience, but you may not have a good feel for their effectiveness. And perhaps there isn’t a cadence to your ‘touches’, that is, a systematic communications plan with some frequency to maximize impact. Further, you may not have a feel for your Revenue Funnel and budgets.

This is an indication that you have not:

- Evaluated available communications tools / media based on their ability to help you target your audience, deliver cogent messages, control costs, and provide the highest yield potential.

- Planned programs that emphasize frequency to maximize impact of systematic communications and touch individuals, at their moment of readiness when they’re ready and able to volunteer themselves as prospective buyers

- Connected revenues and budgets

Metrics-Driven Methodology

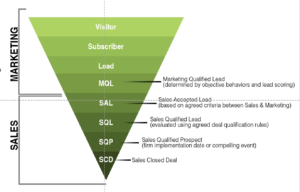

To build a metrics-driven advisor engagement strategy, the first step is to connect your business model / budgets with your goals. The next step is to build a good understanding of your Key Performance Indicators (KPIs) or measurable values that will show the progress of your business goals. Examples include:

- Number of Marketing Qualified Leads (MQL)

- MQL conversion % to Sales Qualified Leads (SQL)

- SQL conversion % to new clients

- Client Lifetime Value

Second, create a high-impact, results-focused marketing plan, choosing tools and media channels in the context of:

- Target Audience Reach (how many)

- Frequency of Reach (how often)

- Impact (engagement/response potential)

- Intimacy (relevance, resonance & personalization)

It’s advisable to test and recalibrate your plan and media mix over time. Testing will help to determine the optimal number of impressions or touch points that should be factored into your plan before you begin to see significantly diminishing returns. Testing is also essential to understanding what tactics, messages, content, formats and media are most effective AND cost-efficient.

Start small by using a few key metrics that are easy to track using your marketing automation / CRM; then build from there, ultimately incorporating predictive and other data-driven business intelligence.

Revenue Funnel Metrics

To give your plan a real litmus test, consider reverse engineering your Revenue Funnel and do the “funnel math”: From impressions and leads created at the top-of-funnel all the way through to revenue and ROI at the bottom-of-funnel.

At a high level, there are three steps:

- Establish an effective understanding of the engagement potential for each of your funnel segments and channels

- Tie it back into your hierarchy of metrics (see related post)

- Then model your revenue architecture, that is, the channels and target spend based on top-down market budget and goals.

Taking the Revenue Funnel Metrics approach further, consider the alignment and integration of your Marketing and Sales teams in a ‘closed-loop’ revenue architecture (See related post.) Optimally marketing / sales will:

- Work together to orchestrate the customer experience end-to-end and generate leads, nurture opportunities in the pipeline and ultimately convert sales and

- Track / measure this end-to-end so marketing and sales can attribute revenue to marketing programs and campaigns and see what is working and not working. We call this a ‘closed-loop revenue architecture’.

Bottom line: a closed-loop revenue architecture and metrics-driven methodology will help you measure and optimize a high performance advisor engagement strategy.

See illustrative metrics, listed hierarchically from most important to least important

See illustrative metrics, listed hierarchically from most important to least important