Social media is not just for reconnecting with former classmates and sharing photos from this year’s family reunion; websites like LinkedIn, Twitter, and Facebook and now Google+ can be valuable professional tools when you develop your social media presence with certain relationship building goals in mind. Taking advantage of the possible connections that social media provides and working to develop relationships with potential clients, peers, and competitors can benefit your business in ways that were not possible prior to the age of social media.

Rather than using social media for direct marketing, which is more likely to turn people away, it is most effective to indirectly promote your firm by developing your own individual online presence. Regularly publishing, posting and tweeting on related issues shows that you are active and engaged within the business community, which will in turn reflects positively on your firm. The two dimensions for measuring social media impact are reach and influence. With regular, if not frequent, substantive updates and a large network of followers will help drive the velocity of your practice and give you the benefit of positive name recognition.

One of the most effective ways that you can take advantage of social media’s networking opportunities is to collaborate with both peers and competitors in order to learn from their business practices. Join an industry group on LinkedIn and start a discussion to share tips on anything from best investment practices to which software to use. Collaborating with peers online also allows you to gain a better understanding of what they deal with, which will help you to be better prepared to work with them offline.

You can also use social media to your advantage by developing closer personal relationships with clients. Friend clients on Facebook and follow them on Twitter. You will develop a better understanding of your client as a person, which will allow you to plan better for them and therefore increase their overall satisfaction. In browsing their profile you might discover a mutual interest that could influence investment plans, and responding to their posts will show that you are engaged and attentive. Conversely, your clients will get to know you better by following your updates, allowing for a more personal and natural relationship. Advisory firms that want to draw in younger clients and investors will need to tap into social media. Of course, you must weigh your own public persona and determine how visible and transparent you want to be. Each channel has unique characteristics which may make it more suitable for personal use rather than business use. Compliance considerations are always there – but increasingly managable with a combination of tools and policies.

There are certain limitations to keep in mind when diving into the social media world. Posts are typically best kept brief – mandatory on Twitter – and nuance is easily lost, so tread carefully. There are also certain rules that regulate advisers’ public communications in order to protect investors. The SEC has not yet established any rules or guidelines specific to social media, which has allowed advisers working at small firms more room to move when working with social media. The Financial Industry Regulatory Authority (FINRA), however, has issued rules for the use of social media, requiring broker-dealers to be more formal and deliberate in their social media communications.

Provided that these rules and limitations are managed, social media networks can be a highly effective tool to benefit your business through relationship building. Be active and engaged in the online community and your growing online network will benefit your business offline, too.

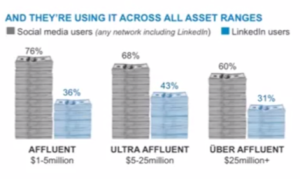

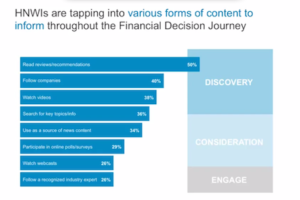

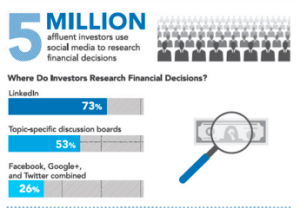

Since the private equity business is dependent on relationships with a finite number of LPs, executives and entrepreneurs, you need to be sure you can identify every potential opportunity to engage with your target audience. With 3 out of 4 Americans using social media, various platforms like

Since the private equity business is dependent on relationships with a finite number of LPs, executives and entrepreneurs, you need to be sure you can identify every potential opportunity to engage with your target audience. With 3 out of 4 Americans using social media, various platforms like