Ending Content Confusion: Differentiating Between “Domain-Centric” and “Engagement-Focused” Content.

There’s a significant problem with content today that can no longer be ignored. It’s the “elephant in the room”—and some organizations and marketers are aware of it, and some aren’t. It’s that the vast majority of the data from marketing practitioners, benchmark reports, industry analysts, and a multitude of other sources suggests that the #1 objective of content is lead generation and account/buyer conversion, sometimes expressed as “engagement”: (and yes, brand awareness tops some lists). Yet, almost universally, content strategy and content creation is “owned” by Product and/or Corporate Marketing in 60% – 80% of organizations. It’s driven by the Demand Generation team in only 5% – 10% of organizations!

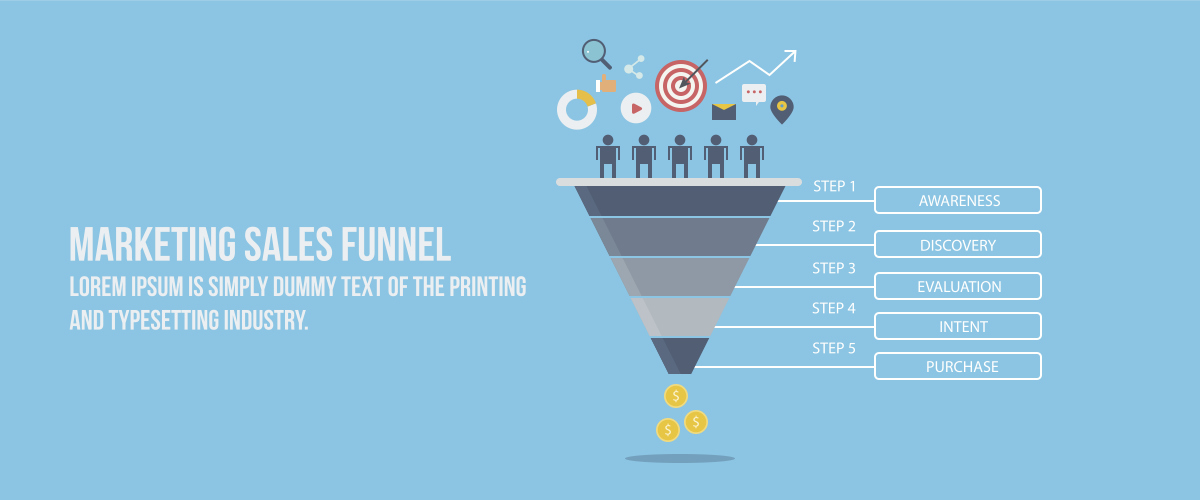

So, let’s get this straight. The primary objective for content is to top-of-funnel inquiries, leads and converting full-funnel opportunities, yet the very people tasked with creating integrated programs to drive that objective DO NOT control the #1 MOST IMPORTANT element which is critical to achieving it? HUH?! Seriously?! That’s like having a plumber wiring your house and an electrician installing the pipes. This can truly blow your mind!

OK, as I step back from the ledge, please allow me to share a highly-informed perspective on this based on a nearly 25 year career in B2B marketing, buyer engagement and demand generation. It’s critically important to acknowledge and understand the difference between “domain-centric” and “engagement-focused” content. Is this starting to make a bit more sense?

The CMO of a “Top 50” B2B technology company said he saw tremendous efficacy in our buyer engagement frameworks and methodologies…but asked himself, and me, the question: why would he need our help with content when he has an dedicated, well-staffed team of product marketers producing it? Then bam…the ability to articulate this difference, which was percolating in my subconscious, hit me right between the eyes. I framed it as “domain-centric” vs. “engagement-focused” content, and the CMO immediately embraced the distinction.

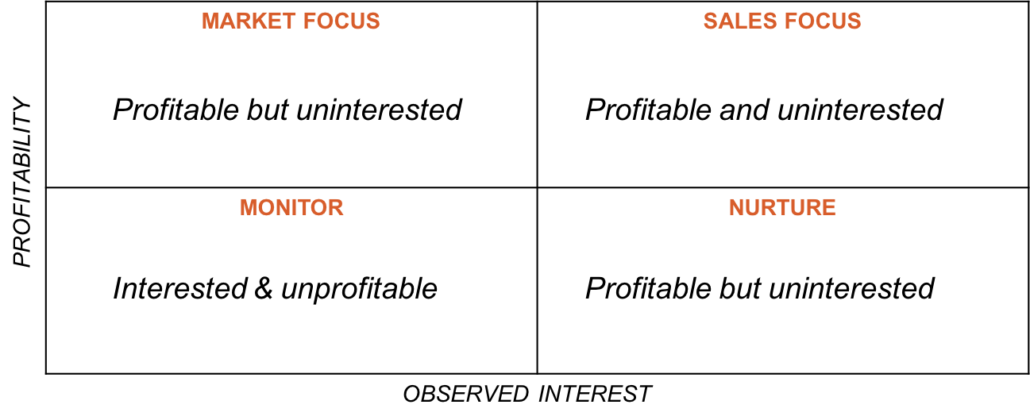

Seems like I sort of threw Product Marketing under the bus, right? Actually, quite the contrary. Product Marketing sits at the intersection of Product Development/Management, Sales, Corporate Marketing, Demand Generation and Field Marketing. As such, they are the single most important information resource in content marketing today. They arguably know more about your products, value proposition, market segments, buyers, market trends, etc. than anyone else in your organization. The disconnect I see, universally across organizations, is that most are classically trained product marketers…schooled in research, creating and articulating value propositions, describing features and benefits, and creating stellar product collateral.

That’s where we Demand Marketers come in and the hand-off begins. By looking through the various white papers, data sheets, collateral, and sales playbooks the Product Marketers have created, Demand Marketers can find what they (and you) are looking for. It’s content that’s embedded and buried within, and it serves a different purpose and context than what is truly useful for buyer engagement. There, in the guise of product and benefit information, you’ll find the buyer’s key pain points, as well as an articulation of how your company, products and solutions help address them. Then you can apply all the insights in our new game-changing eBook entitled Exposed. The False Promises of Revenue Marketing. to create truly effective engagement-focused content.

To discover more in-depth insights on this topic, download a copy of the eBook by simply clicking on the link below to discover 9 principles to exponentially increase leads, conversion and pipeline velocity:

DOWNLOAD NOW!

See illustrative metrics, listed hierarchically from most important to least important

See illustrative metrics, listed hierarchically from most important to least important